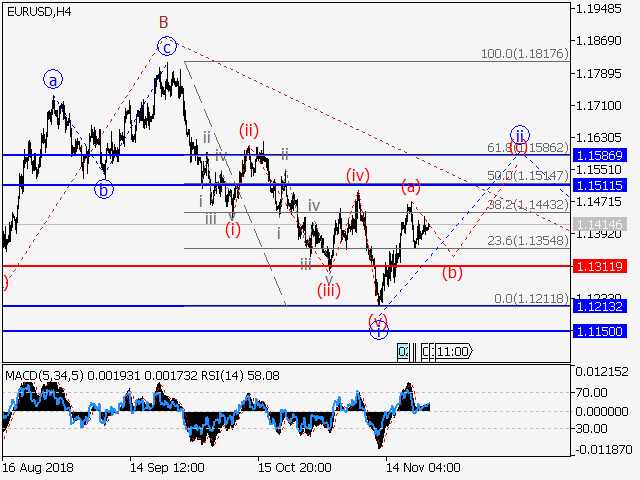

The pair EUR/USD is still likely to grow. Estimated pivot point is at a level of 1.1311.

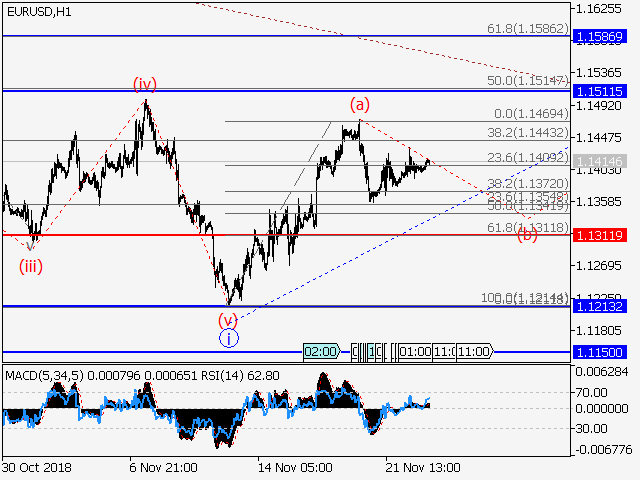

Main scenario: long positions will be relevant from corrections above the level of 1.1311 with a target of 1.1511 – 1.1586.

Alternative scenario: Breakout and consolidation below the level of 1.1311 will allow the pair to continue declining to the levels of 1.1213 – 1.1150.

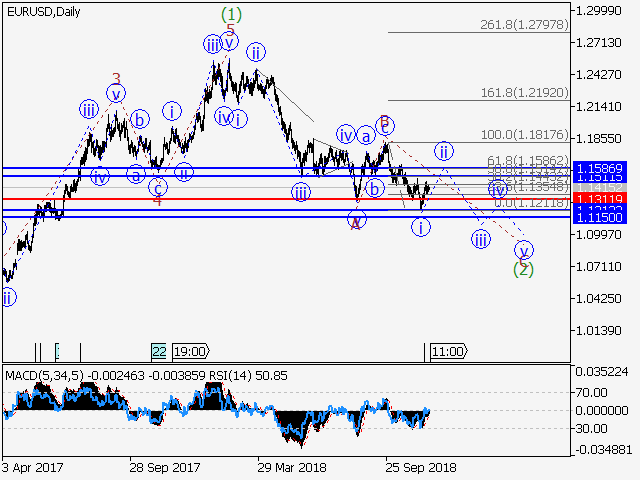

Analysis: Supposedly, a descending correction of senior level in the form of the wave (2) continues to develop within the daily frame. Presumably the wave С of (2) is developing on H4 timeframe, with the wave i of C formed and an ascending correction forming as wave ii of C inside. On H1 timeframe, apparently the wave (a) of ii has formed. If the presumption is correct, the pair will logically continue growing to 1.1511 – 1.1586 once the wave (b) of ii has finished. The level 1.1311 is critical in this scenario.

Do You Want To Make Thousands Of Dollars Extra Cash Every Month

From Forex Trading In Pakistan?

Subscribe To Our Mailing List And Get Free Forex Training Videos, Free Forex Trading Strategies, Free Forex Indicators, Robots And Free Forex Analysis From ForexGuru.Pk Team In Your Email

We Respect Your Privacy And Protect It Seriously